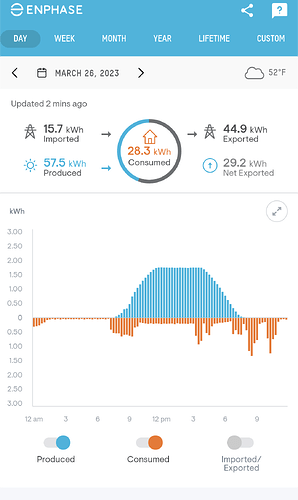

What’s obvious above is that I have some clipping. Let me describe my system.

My system is a 9.49kW (dc) setup - 24x 395W Canadian Solar panels with Enphase IQ8+ microinverters, (290VA max continuous, 300VA burst), and the BOP for Enphase Sunlight Backup. More info on that here and here. Short version: The system can island itself with an ATS and keep ~30% of the AC nameplate capacity when grid is lost but sun is shining. I’m in a location where I expect about 12.5MWh/year from this system, 4-4.25 average hours of sun per day in the cloudy Midwest. Adding Sunlight Backup to the proposal added about $3k.

I heavily rely on the grid to be my free infinite battery, especially seasonally, since my home is all-electric and most of our energy use is in the winter and less in the summer. Net metering here isn’t bad, I have monthly true-up and get paid out about half of retail in months that I overproduce. This seems pretty fair and very simple.

This system was energized in January after a long arduous process with an installer that hadn’t ever done and IQ8 system before- papers signed in June, panels up in October, first production in January. Oof. Since my system came online in winter, every day this spring has the potential to set a new production record! Yesterday I made 57kWh which is great!

Clipping is an issue. When the installed proposed putting 290VA continuous-rated microinverters on 395W panels, I was quite hesitant. They told me they’d done the math and showed some familiarity so I went with it. When I observed the clipping starting so early, I asked them to give me their numbers and they sent me this which seems to indicate I’m still in the best position financially:

-

iQ8M (330VA continuous) micros in lieu of iQ8+:

- Increase in proposal cost for difference in equipment price = $1,179

- Increase in annual production of 186 kWh. Value @ current $0.116/kwh = $21.576/year

- ROI = over 54 years

-

iQ8A (366VA continuous) micros in lieu of iQ8+:

- Increase in proposal cost for difference in equipment price = $1,579

- Increase in annual production of 209 kWh. Value @ current $0.116/kwh = $24.244/year

- ROI = over 65 years

Naturally the cost difference is a key factor- they’re calculating with +$49/ea for the IQ8M whereas it’s only a $20 price difference on Enphase.com, and the ROI would technically be different but probably still not enough to make it worth it. I’m not seriously considering asking them to change out the inverters at this point, just making sure I understand the situation.

So it seems like ~25% over-paneling is within economic range now, clipping be damned. What do you all think?